Personal note: in 2022 I was diagnosed with a grade II astrocytoma. I was fortunate enough to have a great surgeon, a great neuro oncology team, and insurance that covered most of it.

I can't fathom how I would have traversed it without the support I had. So this isn't just personal, I have had my support, it is for all of us. Even, potentially, you dear reader.

Early 2024 Public Support Aging and Voting Drug Pricing and Politics

The case for Medicare For All, which, for the most part, in this argument can be considered a stand-in for any tax-based financing universal healthcare system, is not only the most ethical and moral system the United States can currently provide, but is also a boon for our national defense and is, in the long term, the most sound financial direction for our nation to take in regards to both total costs and productivity.

While we will attempt to avoid appeals to emotion/pity/etc that some unscrupulous and bad faith actors would use to simply throw this entire argument away, which would be factually incorrect and an argument from fallacy itself, we can not honestly approach a topic like Medicare For All and Universal Healthcare without speaking of the thousands of lives that would be saved annually and the extreme and eternal quality of life improvements the American public as a whole would experience under a Medicare For All system.

The Status Quo Kills, Still.

Prior to Obamacare, which helped improve coverage and dropped the number of uninsured by almost 20 million, an average of 26,240 Americans died each year between 2000 and 2006 due to not having insurance.

Which, according to Families USA, was more than double the number of Americans that are murdered each year.

Another study from 2009 by the Cambridge Health Alliance at Harvard puts this number closer to 45,000 and concluded that uninsured working-age Americans have a 40% higher risk of death than insured working-age Americans.

Unfortunately, these numbers are set to rise again. By 2025, it's projected that 23-25 million Americans will be uninsured, a significant increase from recent years. This uptick is largely due to the expiration of enhanced Affordable Care Act (ACA) subsidies and the "unwinding" of the Medicaid/CHIP eligibility renewals that began in 2023, causing millions to lose coverage despite still being eligible.

The Congressional Budget Office (CBO) projected in 2024 that 17 million people would lose Medicaid coverage in the coming years due to these administrative changes, exacerbating the crisis. And let's not forget the "missing Americans" – an estimated 338,000 excess deaths annually in the U.S. compared to other wealthy nations, many attributable to our convoluted, for-profit healthcare system. This isn't just about insurance; it's about a fundamental failure of public health, underscored by a critical primary care crisis that leaves millions without basic access to preventative care, pushing them into costly emergency rooms only when it’s too late.

Uninsured Americans by State (2025 Projections)

| State | Projected Uninsured Rate |

|---|---|

| Texas | 18.0% |

| Oklahoma | 14.5% |

| Georgia | 13.8% |

| Florida | 13.5% |

| Arizona | 12.7% |

| North Carolina | 11.9% |

| Mississippi | 11.5% |

| Nevada | 11.0% |

| Wyoming | 10.8% |

| Kansas | 10.5% |

Source: Center on Budget and Policy Priorities; The Commonwealth Fund

While correlation does not necessarily equal causation, it very often points in the right direction. Happiness is, of course, based on more than health alone. However, happier people tend to be healthier people and vice versa.

Furthermore, and speaking once more on life, the United States' life expectancy in 2025 hovers around 76.4 years. This is a full 6.6 years less than our neighbors to the north in Canada, who, by the way also rank 15th in the world happiness scale - again, significantly better than we do at 23rd. So on both life and happiness we are lagging behind... and dying - unhappily, but presumably relieved as our debt can no longer be sold or sought after. You know, since we're dead. So we've got that going for us.

Life Expectancy and Happiness Rankings (2024/2025)

| Country | Life Expectancy (Years) | Happiness Rank |

|---|---|---|

| United States | 76.4 | 23 |

| Canada | 83.0 | 15 |

| Finland | 82.4 | 1 |

| Denmark | 81.4 | 2 |

| Iceland | 83.2 | 3 |

Source: World Happiness Report 2024; WHO Global Health Observatory; Statistics Canada

... but liberty! Oh, liberty how we sing of thee. We've got a statue for that. Indeed, given to us by another nation providing Universal Healthcare [thanks France, oh and also for that whole helping us defeat the British thing...] and we sure care about it.

We care so much so that Trump's immigration chief, Ken Cuccinelli, has suggested that Emma Lazarus' "The New Colossus", the famous poem adorning the inside of the pedestal of the Statute of Liberty, needs a modern rewrite. While he has not yet blessed us with his full edit, he did give us a hint of the direction he had and still has in mind when he gave us the following line: "Give Me Your Tired, Your Poor Who Can Stand On Their Own Two Feet."

So while it should be concerning, it should not be surprising that on October 4th, 2019 Trump released a proclamation that suspends immigration unless immigrants prove they have insurance or enough money to pay for "reasonably foreseeable health insurance costs." This moves the United States' immigration system ever closer to a pay-to-play system. So much for "Give me your tired, your poor, your huddled masses yearning to breathe free." A reckoning for both the American consciousness and conscience is coming - or it has already arrived.

Unsurprisingly there are rankings for liberty (if you read it as, essentially, freedom) and the first one we will be using is from the Cato Institute. Founded by Charles Koch (a major GOP donor), Murray Rothbard, and Ed Crane. In fact it was once called the Charles Koch Foundation.

According to their own research, the United States ranked 20th in the 2024 Human Freedom Index. That's a drop from 17th in 2017. It's almost as if eroding social safety nets and tying healthcare to employment makes people feel less free. Who knew? The global decline in freedom, highlighted by the report, often correlates with declining well-being – a trend the U.S. seems intent on leading in.

Another ranking, from Patrick Rhamey, a professor in the Department of International Studies at the Virginia Military Institute places the US outside of the top 10 in 2019, but in the top 20%. So again, not bad, but not what we claim to be after as a nation.

Happiness and Freedom Index Rankings (2024)

| Country | Human Freedom Index Rank | World Happiness Rank |

|---|---|---|

| United States | 20 | 23 |

| Switzerland | 1 | 9 |

| New Zealand | 2 | 10 |

| Denmark | 3 | 2 |

| Canada | 6 | 15 |

Source: Human Freedom Index 2024 (Cato Institute); World Happiness Report 2024

We've been close before...

One of our most successful, popular, and our longest serving president, Franklin D. Roosevelt, believed that the original rights granted by the constitution and bill of rights had not done enough to ensure the three main rights outlined in the declaration of independence, or as he stated: "proved inadequate to assure us equality in the pursuit of happiness."

FDR's "second Bill of Rights" [watch it or read it], unfortunately never came to fruition.

However, George C. Marshall, once FDR's Army Chief of Staff (which is highlighted specifically for the sake of this discussion, he did and was much, much more than that), would later, as Secretary of State under President Truman, implement the Marshall Plan. His plan, officially known as the European Recovery Program, aimed to lift Europe out of the ashes and catastrophic devastation of World War II.

Several key objectives of FDR's ambitious "economic bill of rights" would find their way into the plan and arguably helped set the foundation for many of the economic and governmental systems now in place throughout much of Europe. Quelle coincidence.

As a nation, who are we? What do we want to be?

Without running the the entire gamut of moral and ethical universal healthcare arguments between then, now, and to come, it may serve better for the purposes of this argument to simply state that we believe much of the argument can be distilled into a quote given 40 years ago by Hubert Humphrey - the son of an immigrant - who served as a Vice President, Presidential Nominee, and Senator from Minnesota:

"It was once said that the moral test of Government is how that Government treats those who are in the dawn of life, the children; those who are in the twilight of life, the elderly; and those who are in the shadows of life, the sick, the needy and the handicapped."Vice President Hubert Humphrey

For those whose ears perk up, mouths water, and tails begin wagging when they hear the big elephant open the door and scream "TAX CUTS", please take notice of the steep decline the "Tax Cuts and Jobs Act" created for Corporations (making a single corporate tax rate of 21%)

and the relatively small drop for individuals - which, and here is the real kicker, will expire in 2025. Not for the corporations of course, just for the people. Some food for thought, if you're into that kind of thing.

Speaking of which, corporate profits soared to $3.3 trillion in 2024, yet somehow, the average worker’s share of that economic pie continues to shrink. Employee compensation as a fraction of national income has been on a downward trend for decades, proving that the wealth generated isn't trickling down – it's being hoarded.

Taxes are at a historically low rate. Medicare For All can be paid for by higher taxes on corporations and our highest earners along with an amount that is less than what average people already pay for insurance premiums and medical care.

The following charts track corporate profits and taxes over several decades. Click on the image to view the full-size chart. If you'd like to read more, view Corporate Tax Rates in the US

View full-sized versions of each chart:

Corporate Tax Rates 1909 - 2018

and

Corporate Profits 1947 - 2019

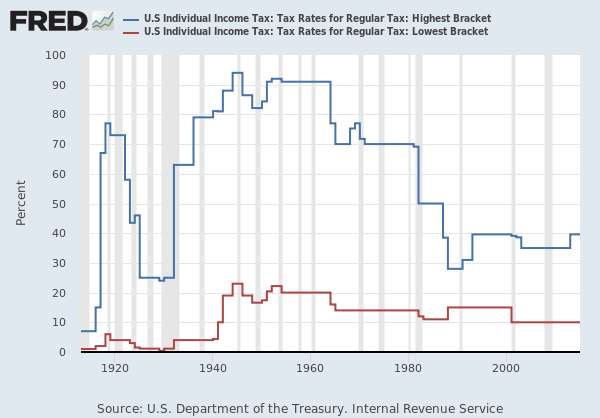

As a follow up thought, for those who believe the 1950s and 1960s (or even the 1970s for those heathens out there) were some golden age of low crime and lower taxes, let us present reality:

You can see that from 1936 until 1980 the top marginal tax rate rose as high as 94% and never dropped below 70% [note: at a point one could not be taxed more than 50% of their total income]. As a reminder, since many often forget and some do not know, one does not simply get taxed according to their final/top tax bracket. Only the money made above the top bracket is taxed at that rate. So if the tax rate is 50% at one million dollars and you make one million and one dollar you will only be taxed 50% on that final dollar. The rest would be subject to the appropriate tax brackets at the lower income levels.

You can click to view graphs on crime as that is not the focus here, but suffice to say, it is quite a bit lower... and again, some intentionally lie and deceive us in an attempt to convince us it is getting worse.

You can click to view graphs on crime as that is not the focus here, but suffice to say, it is quite a bit lower... and again, some intentionally lie and deceive us in an attempt to convince us it is getting worse.

Taxes will go up for some! However shall we survive? Well, probably quite a bit better and easier as a whole. In fact, over time we will almost certainly save money versus the current trend. At the end of the day, most people would prefer, on average, to be healthier and to keep more of their money than they care about their marginal or effective tax rates. Those who believe low tax rates to be some sort of holy indicator of logic and sound decision-making are likely to be surrounded by neither. If you fall into this latter group, you may want to ask yourself why. At least turn it over in your mind once or twice more.

So again, while taxes will have to go up as a whole, the overwhelming majority of Americans will save money when one combines the cost of their taxes, their insurance premiums, and their medical expenses.

This can be explained rather simply (perhaps too simply, but alas...) by imagining a single dollar. This is your dollar. Let's say taxes are currently 15 cents of that dollar and your medical costs (copays, prescriptions, premiums, etc) are another 10 cents.

At the end of the year you are left with 75 cents to spend on the myriad of other expenses we are beholden to and maybe, if you're lucky or plan well enough, you may even manage to save some of that. Which is sadly quite uncommon as according to a CBS News Report, most Americans currently can not cover an unexpected $500 dollar emergency without going into debt.

Now if we roll Medicare costs into the tax system, premiums no longer exist. Prescription costs also need to be addressed (allow for negotiation as well as importation), and they too will cost us less as a whole. At the end of the day you may now pay 20 cents in taxes on that dollar, but you are now left with 80 cents instead of 75 cents. A net gain. Which, in the end, is what matters when it comes to budgets and one's finances. Additionally, we obtain the psychological relief of an entire nation that can collectively feel as it no longer has to worry about going bankrupt over a medical procedure. The average American quality of life would almost certainly go up.

The Price of Sickness: A 2025 Update

In 2025, the average annual premium for employer-sponsored health insurance continues its relentless march upward. For a family plan, prepare to shell out an estimated $25,000 per year, while single coverage isn't far behind at about $8,500 annually. And don't forget those charming deductibles, which average around $1,800 for individuals and a cool $3,500 for families. It's almost as if the system is designed to extract maximum profit before providing minimum care.

Average Annual Health Insurance Premiums (Employer-Sponsored, 2025 Estimates)

| Coverage Type | Estimated Annual Premium |

|---|---|

| Single Coverage | $8,500 |

| Family Coverage | $25,000 |

Source: KFF 2023 Employer Health Benefits Survey (extrapolated for 2025)

Average Household Spending on Healthcare (as % of Total Budget, 2025 Estimates)

| Category | Percentage of Household Budget |

|---|---|

| Healthcare | 17.0% |

| Food | 12.5% |

| Housing | 18.0% |

Source: BLS Consumer Expenditure Survey (extrapolated for 2025)

...but socialism! cries the dishonest and/or unaware amongst us. Yes, indeed, socialism! Spooky. Except it is socialism only in the sense that we as a nation have agreed to pay taxes to provide services for the people of our country. That is the kind of 'socialism' being discussed. The only red scare here is how much the ER will charge should you have the misfortune to bleed somewhere. Really, anywhere people don't tend to regularly bleed from. You shouldn't be scared to go somewhere when this happens. One of the first thoughts when in pain should not be: "How am I going to pay for this, should I even go? Can I afford it?"

That is indeed scary and unlike those who slippery slope their way to some Lenin and Stalin-esque fever dream of the means of production being stolen from them, this is actually founded in reality.

People are forced to worry about current and potential medical costs every single day and it is completely unnecessary.

This is simple, really, we already do all sorts of things that could be defined as 'socialism' due to them being supported by taxes. This is because we are already in a partnership as a society and a nation with, at least in general, relatively similar goals. The problem for those that decry such public funding is that these things are really, really important - to nearly everyone. They include public education, social security, the military, and that which is much more important for this discussion: Medicare and Medicaid.

We already provide Medicare or Medicaid coverage to approximately 135 million Americans in 2024/2025, covering roughly 40% of the country. Medicare is also consistently the most popular form of health insurance when it comes to costs and coverage, with approval ratings far exceeding private options.

As Representative Pramila Jayapal once so eloquently put it, "Medicare and Medicaid are not entitlements; they are earned benefits, fundamental promises to the American people." Yet, despite their popularity and necessity, these vital programs are under constant assault by those who would rather see them privatized and dismantled for profit. The wet paper towel supporting the rest of the system is already beginning to sag and fall apart. Again, the middle can not and will not hold. It will start, if it hasn't already, to adversely affect the 40% already on Medicare and Medicaid. So if you happen to be part of that 40%, you also have a vested interest in the system holding and expanding. We need you to help us. Please vote for candidates that support expansions to health coverage. Not high-risk pools, which double costs for those in them and other farcical and already failed attempts at placating the sick, the tired, and the non-rich. It is dishonest, it is deliberate, and it is deadly.

According to research from the Bureau of Labor and Statistics the poorest amongst us pay nearly 35% of their pre-tax income on healthcare. Those in the middle pay around 10%. Which is why we used 10 cents on the dollar in our example above. We are already paying for care that is not guaranteed, increases significantly year over year, and causes death, bankruptcy, anxiety, and fear.

We can do better, we have to do better, but again, we can not do that without your votes and your support.

Medicare Physicians

There are already millions of providers who accept Medicare, which would only grow under a Medicare For All system - which is yet another incentive for those already on Medicare or Medicaid to support the movement.